Introduction – Well begun is half done

In the first months of 2023, Trader Joe saw constant and consistent growth, both in terms of transacted volume and TVL.

According to DefiLlama, TVL spiked from $75M at the end of December to the current $130M, while monthly volume went from $850M to $2.2B in the same timeframe. In the last 7 days only, the DEX processed $609M in transactions, with a WoW 28% that allowed Trader Joe to rank fifth among all exchanges in terms of weekly volume.

Solid numbers, especially for a bear market.

But what are the catalysts behind the substantial growth of Trader Joe?

Trader Joe V2: more yield, less slippage

In November, Trader Joe launched its V2 which featured the Liquidity Book, a novel AMM protocol leveraging concentrated liquidity.

Similar to Uniswap’s V3, Trader’s Joe Liquidity Book allows users to provide liquidity along specific price bands, called “bins”.

By distributing liquidity into specific price ranges, which ideally should correspond to the ranges in which tokens are traded the most, its efficiency and depth are greatly improved, allowing LPs to earn more while experiencing lower slippage. For swaps between bins, there’s no slippage at all.

However, there are some subtle differences from Uniswap’s V3, with the main ones being:

According to DeiLlama, from its launch Trader Joe V2 gained more and more traction, outshining its older V1. On 30/03, Trader Joe V2 processed $237M in daily transactions, against the $4.8 processed by the V1, while V2 March’s monthly volume went from $1.23B to $2.04B.

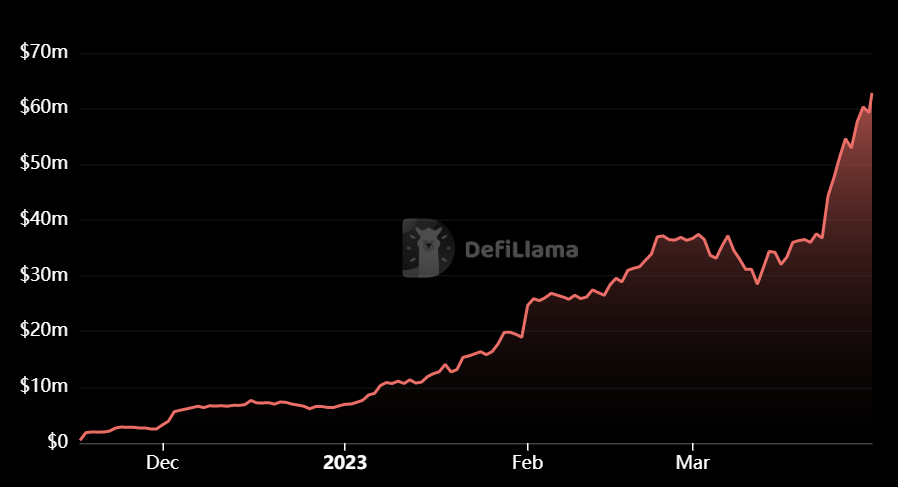

Even in terms of TVL, the Liquidity Book surpassed its predecessor ($62M vs $58M), constantly growing from its launch.

However, the Liquidity Book implementation wasn’t the only catalyst that helped Trader Joe achieve growth. Another important part of why the DEX eclipsed most of its competitors was played by Arbitrum, on which Trader Joe launched at the end of the year.

Arbitrum: airdrop, incentives and mercenary capital

Since its launch on the Ethereum L2, Trader Joe saw exponential growth on its chain, in terms of TVL, volume and fees.

According to DeFiLlama, on Trader Joe V2 funds deposited on Arbitrum almost reached the ones deposited on Avalanche ($29M vs $30M), while March’s monthly volume on Arbitrum went from $260M to $806M and monthly fees went from $807K to $2.42M.

While the growth on Arbitrum seems pretty impressive, it’s difficult to establish if it was organic or not. Is it fair to assume that part of the volume was probably generated by late $ARB airdrop hunters (the snapshot was taken on the 6 of February) and by liquidity farmers, willing to receive a share of the 300k $JOE tokens awarded as incentives for liquidity providers and loaners on $ARB pairs, as part of the incentive programs launched by the DEX.

It will be interesting to see if the protocol will keep growing on Arbitrum after the incentive program, which is set to end on April 6.

Conclusion

Numbers at hand, in the first months of 2023 Trader Joe has been is one of the most successful protocols in the space, growing faster than all DEXs in the top five. (source: DeFiLlama)

Besides growing consistently on Arbitrum (fun fact: Trader Joe was awarded 900k $ARB tokens during the airdrop), Trader Joe remains the undisputed leader on Avalanche with its $274M in volume over the past week.

As we can see on Dextools.io, 7 out of 10 hot pairs on Avalanche are currently traded on Trader Joe.

Trader Joe’s 2023 began in the best way possible: a new product, multi-chain integrations, growing KPIs. So far so good.

Trader Joe’s currently ranks #14 among DEXes for TVL, while currently being deployed only on 3 chains. For being in a bear market, it surely has displayed impressive numbers and consistency in building innovative products and nurturing its community.

Will it be enough to make it to the top 10?

Article by: Gioele La Morgia